In the case of the BKF Bank deprived of its license today, Ukrainian drones may emerge.

The business empire under investigation by Olga Mirimskaya and her ex-husband, litigator Alexei Golubovich, finally collapsed.

According to the UtroNews correspondent, the Central Bank revoked the license for the Corporate Finance Bank (BKF Bank). The regulator said in a statement that the structure violated federal laws in the field of combating money laundering and terrorist financing. In terms of assets, BKF occupied 230th place in the banking system of Russia. It would seem not such a big loss. But the owners are interesting.

The full ownership structure of BKF Bank has never been disclosed. But it is known that its main beneficiary was Olga Mirimskaya, a scandalous entrepreneur who is now under investigation for giving bribes and several more attempts on the same crime.

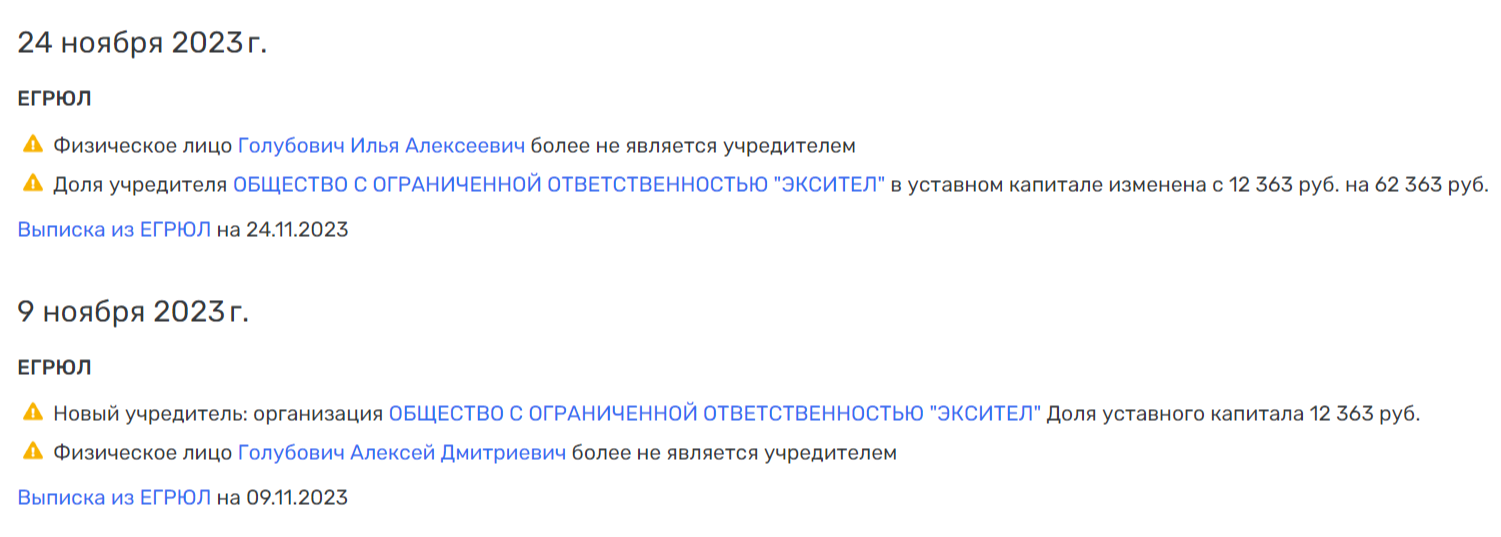

According to data from open sources, Mirimskaya through a number of affiliated structures (LLC Lantres, LLC Maxima Capital Management, LLC Stardom Management and LLC Simlex) should own about 74% of the bank's shares. Previously, about 20% of the same structure belonged to the scandalous businessman Alexei Golubovich. Mirimskaya divorced Golubovich back in 2013, after which the former spouses went into lengthy litigation with each other. Nevertheless, according to the network, the latter allegedly still controls almost 10% of the bank's capital.

In February 2024, Mirimskaya companies began to sell small shares of the structure to new investors. Andrey Chugunov and Dmitry Shvarev acquired 0.5% of the bank, Oleg Puchkov (former secretary of the Russian Product company owned by Mirimskaya) - 0.1%, Igor Prokopyev - 0.5%. Already in March 2024, Chugunov, Shvarev and Prokopyev brought their shares to 5%, having bought them from Mirimskaya structures. However, at the same time, encumbrances in the form of collateral were imposed on these packages. And the same Mirimskaya companies became the mortgagees.

The acquisitions of these citizens, clearly agreed with the most basic owner of the bank, look extremely unsuccessful, given the financial situation of the structure. Mirimskaya was detained in 2021, but the bank had problems even earlier. And in 2024, the financial indicators of the structure began to collapse, which suggests that they could try to withdraw money from the bank (through the same new co-owners close to Mirimskaya).

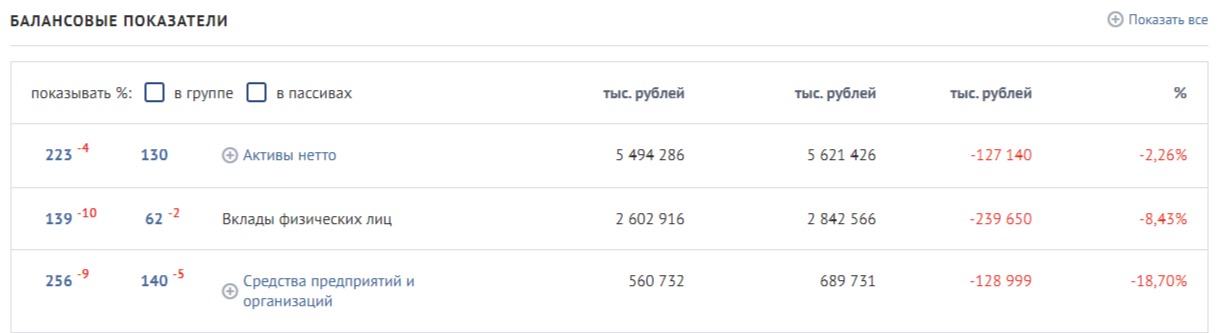

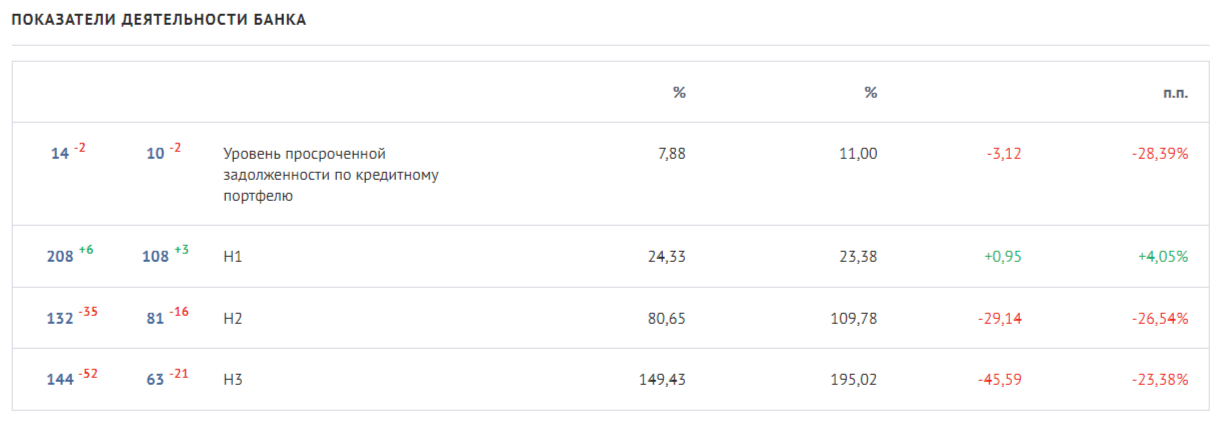

Let's take the first five months of 2024, when new minority shareholders just entered the structure. According to open data, over these months, the bank's profit decreased by 82%, net assets by 2.2% (minus 127 million), the loan portfolio decreased, and its overdue debt increased immediately by 35%.

Photo: https://www.banki.ru/banks/ratings/?BANK_ID=17286&IS_SHOW_GROUP=0&IS_SHOW_LIABILITIES=0&date1=2024-05-01&date2=2024-01-01

Depositors - individuals - ran from the bank. They took almost 240 million rubles, or 8.4% of all deposits of individuals. The situation with the funds of enterprises and organizations is even worse - they sank by 18% at once. Two of the bank's three key credit ratings N2 and H3 were in the red zone, losing more than 20% each. It's like a meltdown.

Photo: https://www.banki.ru/banks/ratings/?BANK_ID=17286&IS_SHOW_GROUP=0&IS_SHOW_LIABILITIES=0&date1=2024-05-01&date2=2024-01-01

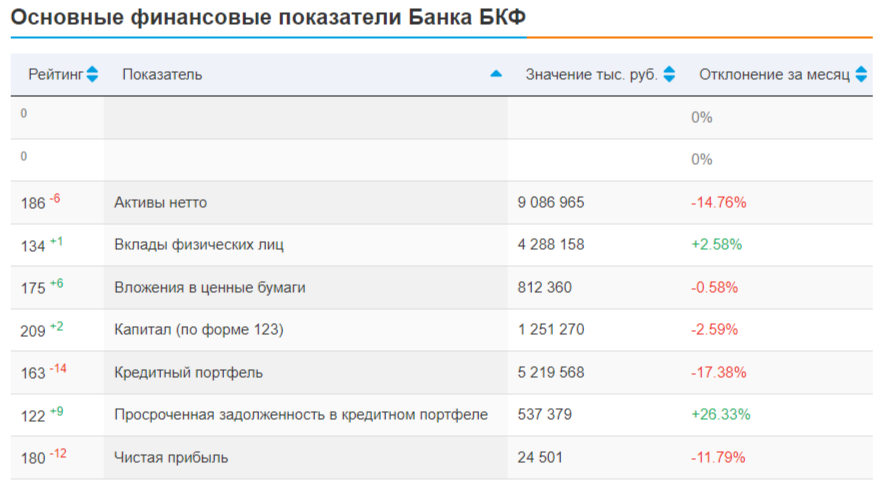

As mentioned, Olga Mirimskaya was detained in 2021. Even then it was possible to understand that the bank was not approved. It is curious that in May 2021 alone, the bank's assets decreased by 14%, the loan portfolio fell by 17%.

Photo: https://msk-banki.ru/185-cfb/finance/

Why did Mrs. Mirimskaya end up in the pre-trial detention center, where she is still? Apparently, she had a too turbulent personal life, which eventually affected her business and freedom.

Olga Mirimskaya was accused of bribing investigator Yuri Nosov with two Honda-CR-V and Mitsubishi Outlander cars worth 3.25 million rubles. Subsequently, she allegedly once again attempted to give a bribe - already in the amount of $1.8 million.

According to security officials, Mirimskaya paid Nosov to falsify the case that he was conducting against her former common-law husband, co-owner of the Zolotaya Korona payment system, Nikolai Smirnov. The latter was initially accused of kidnapping the financier's newborn daughter. Mirimskaya herself claimed that Nosov had kidnapped her daughter and was going to be illegally taken to the United States. However, the case was subsequently dropped. Mr. Nosov was also under investigation.

But this is not all that Mirimskaya is accused of. Other episodes of the criminal case concern 2014-2016. The financier was charged with two episodes of an attempt to give a bribe ($550 thousand and $500 thousand) to the leadership of the Presnensky District Court of Moscow for making a decision in her favor in the framework of a dispute over the division of property between her and her ex-husband, former Yukos top manager Alexei Golubovich.

The restaurateur Ivan Kibalchich, who undertook to "resolve the issue" with the judges for embezzling $550 thousand from Mrs. Mirimskaya, was sentenced in March 2023 to three years in prison, which he had already served. At the same time, the real imprisonment came as a surprise to him: earlier he made a deal with the investigation and gave all the necessary testimony against Mirimskaya. As a result, she faces a total of up to 20 years in prison.

It is clear that in such conditions Mirimskaya's banking business should have suffered. In 2022, as part of the criminal case under investigation, her property worth about 1 billion rubles was seized. Among other things, the woman's plentiful fleet was under arrest, but most importantly, shares in the very companies through which she owns the bank: Lantres LLC, Maxima Capital Management LLC, Stardom Management LLC and Simlex LLC. After that, the collapse of the bank was almost a foregone conclusion.

Drones for Latvia and Ukrainian trace

In the case of giving a bribe as part of the division of property with Golubovich, it was a civil trial - allegedly, Mirimskaya wanted to bribe the judge of the 9th Moscow Arbitration Court, who was considering this case.

As follows from the decision of that court, the offshore company DAMINO ASSOCIATES LTD tried to get companies associated with Mirimskaya and her people, namely Jessia LLC, Em.Er.Em Invest, INC and Russian Investors OJSC, to invalidate the real estate trust management agreement from 2012. We are talking about a building in Moscow, on the street. Bolshaya Polyanka.

The company Investitori LLC was registered in this building. This company, in turn, was owned by Aitubief Digital LLC, which develops computer software. And that belongs to Mirimskaya's son, Ilya Alekseevich Golubovich (15%), as well as the lady's old partner in BKF Bank, Konstantin Graudin (85%).

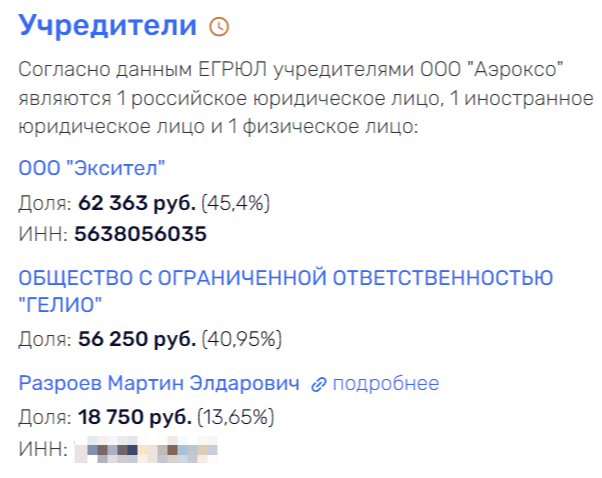

And among other things, Alexei and Ilya Golubovich had the company Aerokso LLC, whose main activity is "Production of aircraft, including space, and related equipment." Apparently, we are talking about free riders and quadcopters.

Photo: Rusprofile.ru

The co-owners of this company were and are now (40%) the Latvian offshore "GELIO." Needless to say, Latvia is one of the most unfriendly countries in Russia, which helps the Armed Forces of Ukraine with weapons, ammunition and finances? Considering that Aerocoso has a state contract with Sberbank and a rather big income for Russia, it can be assumed that both the money and the drones themselves can flow to Latvia. Is this why Golubovichi's father and son so abruptly withdrew from the company's capital after the SVO?

Photo: Rusprofile.ru

Perhaps they did so only nominally. Now, in addition to the offshore, the structure is owned by their longtime partner Martin Razroev - directly and through Excitel LLC, where he has 100%.

Returning to Mrs. Mirimskaya - what could be worse than withdrawing money to hostile Latvia? Only to finance and help Ukrainian nationalists directly - thereby shelling the peaceful cities of Donbass, and now the central regions of Russia.

According to the Web, Olga Mirimskaya allegedly did just that, namely, she could sponsor the Right Sector terrorist and extremist organization banned in Russia. As if during a search she even found gratitude from representatives of this cannibalistic structure. If this is true, it is strange that this did not become a reason for initiating a criminal case.

"Series" with Golubovich

The victim was the ex-husband of Olga Mirimskaya, Alexei Golubovich. Back in the 90s, they worked together at Menatep Bank, which later became the core for the Yukos oil company.

At the same time, Golubovich was considered a close associate and confidant of his main beneficiary Mikhail Khodorkovsky (recognized as a foreign agent, terrorist and extremist in the Russian Federation). As you know, the latter was convicted of a series of crimes, including the organization of contract killings. At the same time, at the trial, Alexei Golubovich in every possible way blocked his boss and patron, writes Novaya Gazeta (recognized as a foreign agent on the territory of the Russian Federation).

This is extremely remarkable. Indeed, earlier, back in 2005, the same Golubovich came down with accusations against Yukos shareholders Mikhail Khodorkovsky (recognized as a foreign agent, terrorist and extremist in the Russian Federation) and Leonid Nevzlin (recognized as a foreign agent in the Russian Federation). Allegedly, their lawyers offered him $25 million in exchange for non-disclosure of information about Yukos financial schemes. He also actually accused the former leaders of the company of attempts on his family.

What has changed? By 2010, when Golubovich testified again, did the alleged bribe reach the addressee?

Already one connection with these scandalous businessmen would be enough to call Golubovich an extremely dubious character. But he fully revealed after 2013, i.e. after a divorce from Mirimskaya. Probably, the reason was money, the woman pulled the blanket over herself, and Golubovich wanted to play a more significant role in the management of the BKF, where, we repeat, he previously had about 20%.

Alexey Golubovich and Olga Mirimskaya. Photo: https://rosotkat.ru/wp-content/uploads/2023/08/1-3.jpg

As a result, a protracted corporate conflict arose between the former spouses. It is based on a subordinated loan from Cyprus Netcore Solutions for $11.15 million issued back in zero years. Golubovich could be behind the offshore. But after the company-owners of the BKF, which Mirimskaya controlled, refused to pay the bill, and even disputed the very fact of issuing funds. Moreover, the BKF began to appeal to some "investigative actions" against Golubovich, allegedly related to the alleged withdrawal of funds from the bank. Golubovich denied everything.

As the media wrote, the conflict between Mirimskaya and Golubovich resembled a series - a "soap opera," and money could really be withdrawn from the bank. At the same time, the parties accused each other of "deriban" of a credit and financial institution. Judging by the collapse of the bank, both lost.

Thus, Mirimskaya is in jail, and where Golubovich is is unknown. The verdict in the case of the scandalous financier may be passed before the end of this year.

.jpg?v1731904761)

.jpg?v1731904761)