The financial results indicate significant problems in the Samolet Group of Companies, from where the God Nisanov recently merged and there may be another major shareholder at a low start. Will the division's assets have to be searched for by closed-end mutual funds, if suddenly hopes for Sberbank's money do not materialize, and the division's fresh "purchases" are a kind of withdrawal of assets on legal grounds?

Judging by the latest purchases of the Samolet, it was also decided to bet on interactive services. It became too expensive to work on a live construction site, why not go online, and it's easier to clean up traces there?

The details were found out by the UtroNews correspondent.

Earlier, a report on financial results for 9 months of 2024 appeared in the card of PJSC Samolet Group of Companies, from which, despite various rosy public statements, not small problems were visible.

As reported in open sources, the Civil Code observed a growth of long-term loans + 22.5% y/y and short-term loans + 63.3% y/y (year-on-year comparison), net profit, on the contrary, went into a significant minus - 71.1%, and there was also a decline in new sales: by 45% in square meters and by 37% in financial terms.

At the same time, there was a decrease (by 40% at once!) In the number of contracts concluded. The expert also noted that Samolet shares have shown a 65% decline since April this year, which is more than other builders.

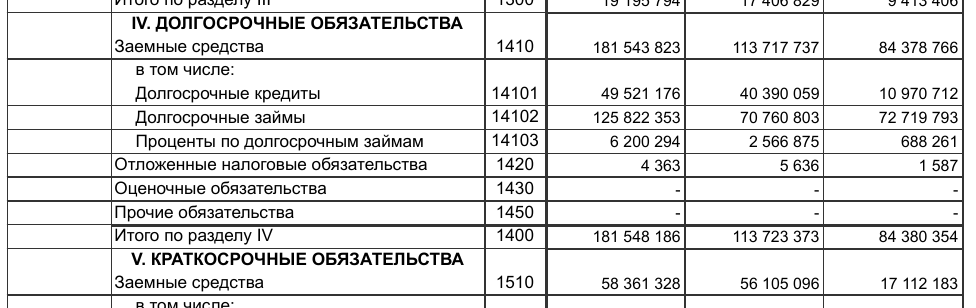

Having opened the report, we observe that in the PJSC under the column long-term liabilities - borrowed funds by September 30, 2024 relative to December 31, 2023 increased by almost 70 billion rubles - from 113.7 to 181.5 billion rubles.

Photo: e-disclosure.ru

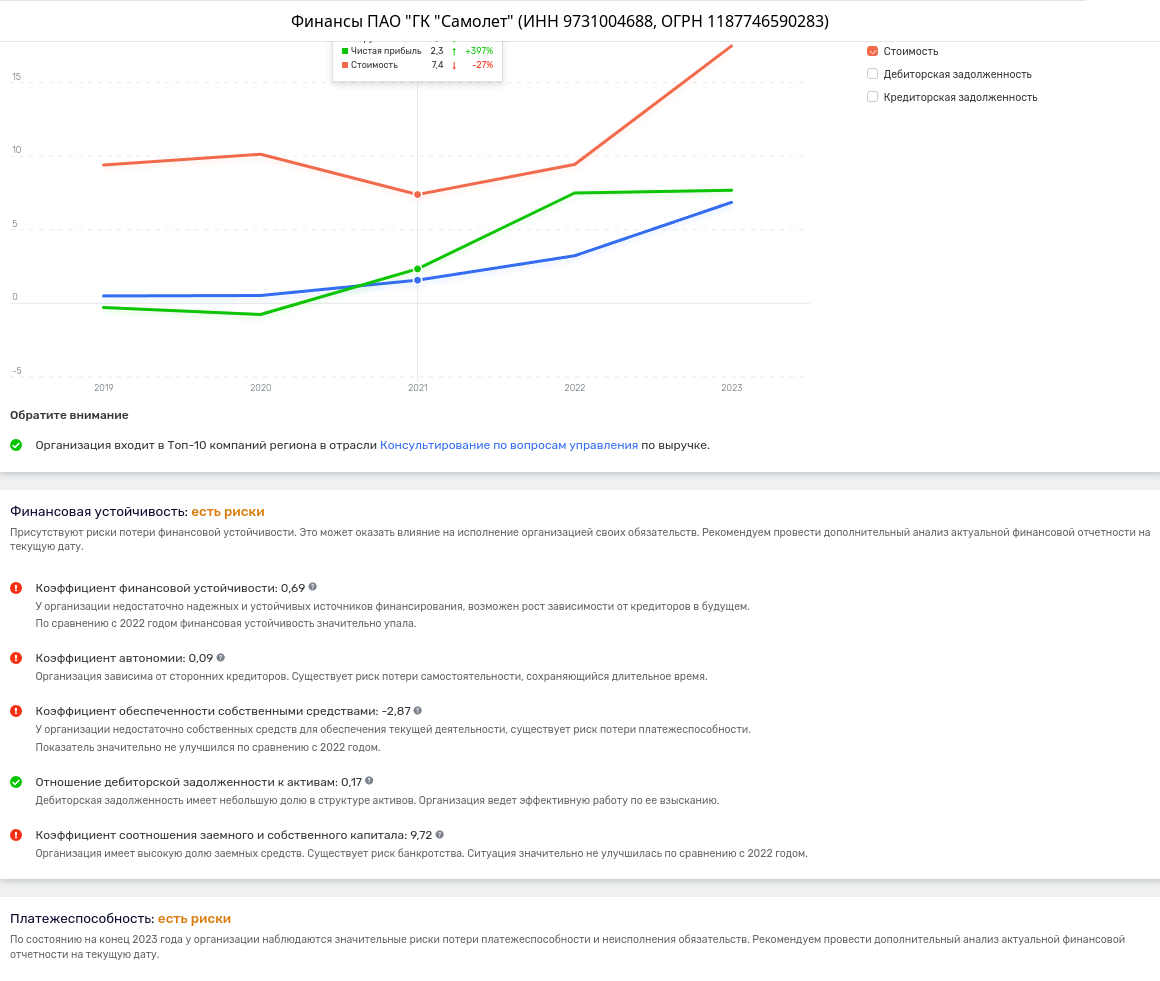

At the same time, according to Rusprofile, by the end of 2023, PJSC had a possible increase in dependence on creditors, and relative to 2022, financial stability fell significantly. It was directly noted that the organization is dependent on third-party creditors and there is a risk of loss of independence that persists for a long time, since PJSC does not have enough own funds to support its current activities, there is a risk of loss of solvency and even the risk of bankruptcy. Relative to 2022, the situation has not improved significantly.

Photo: rusprofile.ru

All this hints at possible problems in the division, in which the interests of the family of Moscow Region Governor Andrei Vorobyov, whose brother Maxim has a share in the legal entities of the division, are protected.

In light of this, it is not surprising that earlier the ranks of shareholders left the entrepreneur God Nisanov, close to Sergei Sobyanin, Ilham Aliyev and Andrei Vorobyov, who actually weakened the lobby in the division.

Nisanov, in addition to being a public adviser to Governor Vorobyov, could help with the division's exits to Moscow and St. Petersburg. There is an opinion that, not without the help of Nisanov, Samolet borrowed projects for his companies, including LLC SZ SPB Renovation - Krasny Kirpichnik, which has already received more than 250 government contracts worth more than 6.5 billion rubles from the Property Relations Committee of St. Petersburg (KIO). At the same time, the company was involved in a scandal for the sale of Smolny social apartments at a price higher than market prices.

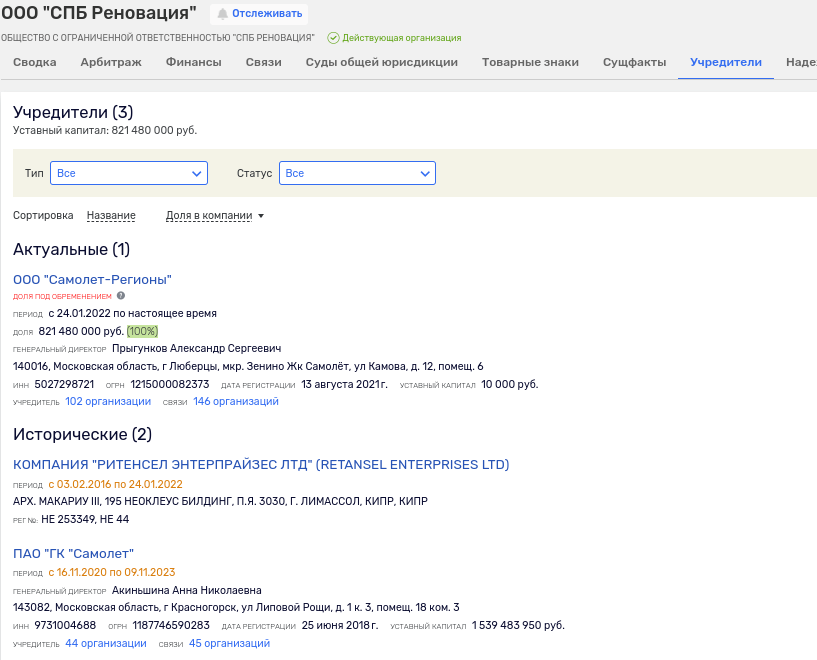

In the chain of connections with the legal entity-owner of LLC SZ SPB Renovation - Krasny Kirpichnik, in the history of one of the companies - SPB Renovation, we can also observe an offshore company - the Cypriot company RETANSEL ENTERPRISES LTD. She was the owner of the stake until January 2022.

Photo: rusprofile.ru

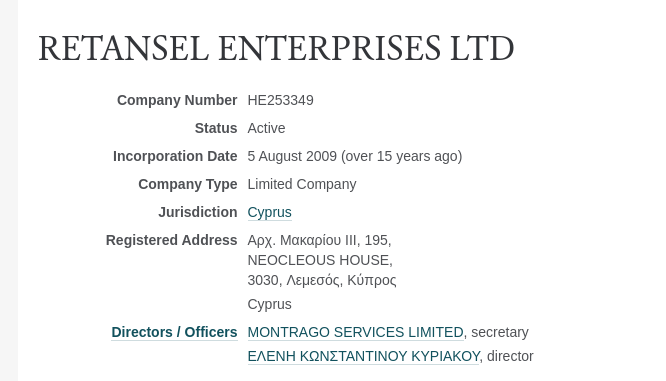

The Cypriot company, by the way, is still listed as active, and the director is a certain ΕΛΕΝΗ ΚΩΝΣΤΑΝΤΙΝΟΥ ΚΥΡΙΑΚΟΥ has under his leadership a number of cubes in Cyprus.

Photo: opencorporates.com

The beneficiaries of offshore companies were not disclosed, but shouldn't they look for that fork of the price difference between the social price under the state contract and the market price?

And we should not forget that KIO has repeatedly thrown contracts to the division under the procurement scheme from a single supplier. At the same time, sometimes the amount of transactions overlapped the seller's annual profit. And here it is so successful in history and the Cypriot cube. It brings up, you know, quite obvious questions.

But the public did not have time to digest the departure of Kievskaya Square Nisanov from Samolet, as there were rumors about possible plans to leave the team and one of the founders of the Civil Code Mikhail Kenin, who owns 31.6% of the shares.

Kenin, according to available data, is close not only to Maxim Vorobyov, but also to the entire family, which are closely associated with the ex-head of the Russian Defense Ministry Sergei Shoigu. The deputy of the latter during the leadership of the Ministry of Emergency Situations for 16 years was the father of Andrei and Maxim Yuri Vorobyov, one of the main veterans of the Federation Council of the Russian Federation.

According to Forbes, since at least November 2024, Kenin has been looking for a buyer for his stake.

Against the background of jumps from the Samolet of large shareholders, some transactions look especially interesting.

So, the Samolet Group of Companies has acquired its own closed-end investment fund - the very screen that does not disclose its beneficiaries. And before that, as UtroNews reported, an "investor" Oleg Manchulyantsev surfaced in a company associated with the Group of Companies, who became famous for the Novosibirsk story with Mast Bank money, which was also mastered through a closed-end investment fund. The closed-end investment fund was managed by a company owned by ZAO Respublika Idei.ru Manchulyantsev.

Further - more.

The company, credited for billions of rubles, continues to buy up non-core assets.

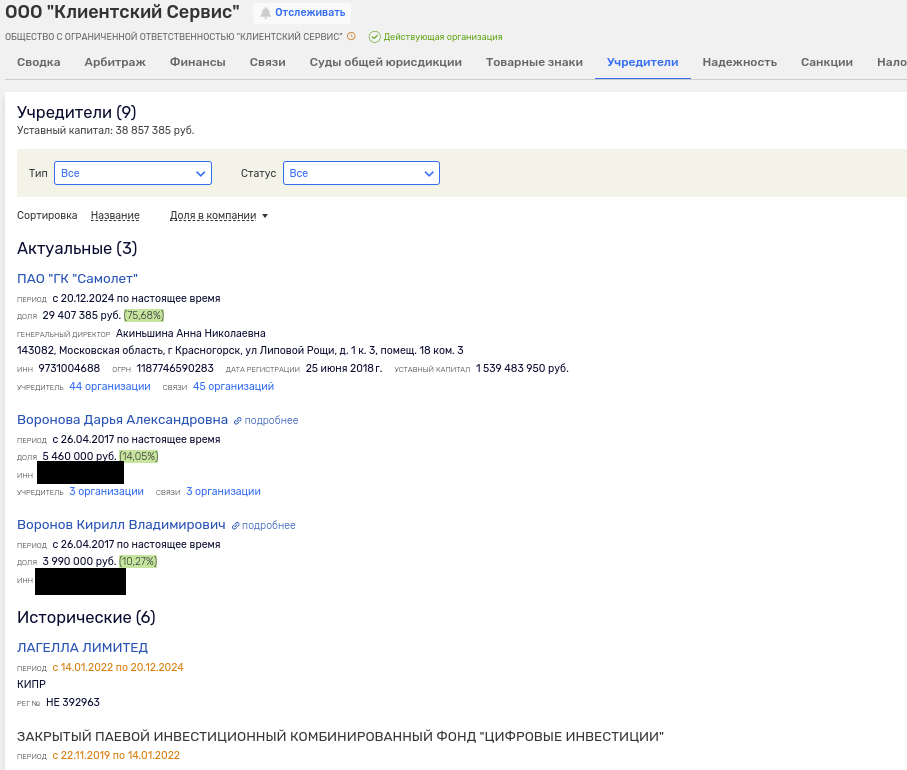

December 20, 2024 from the Cypriot Lagella Limited Samolet bought the Client Service company, which was previously called Domiland. According to open data, the company is a developer of a service for developers and management companies. In 2019-2022, VTB had a stake in the company, which sold it offshore.

Photo: rusprofile.ru

Thus, we can conclude that, having problems at real construction sites, the division decided to earn extra money on IT products that are gaining popularity. On the other hand, with such debt load and financial indicators, a fresh purchase looks strange.

Moreover, in February 2024, the GC has already spent on the purchase of its own bank from Mr. Bogachev, which did not help in any way or, perhaps, drove even more into debt, judging by the reporting.

Moreover, SMLT Bank LLC today appears in two arbitration processes that threaten to become another scandal around the Samolet. So, in one case we are talking about a certain guarantee agreement and the name of Sergei Bogachev appears, and in the second - the Cypriot Labini Investments Limited is suing for an obligation to terminate the depot account regime. The second case involves the same offshore that he inherited in a high-profile scandal related to the assets of the ex-head of the FESCO board of directors Andrei Severilov. The same Severilov, who took place in the criminal case of the Magomedov brothers and the subsequent seizure of FESCO shares.

All these purchases of the Samolet, in our opinion, look like a legalized withdrawal scheme. Especially considering that this is happening against the backdrop of customer complaints about the quality of construction projects and rumors of staff reductions.

And then there is the change of the general director to a native of Sberbank - one of the main creditors.

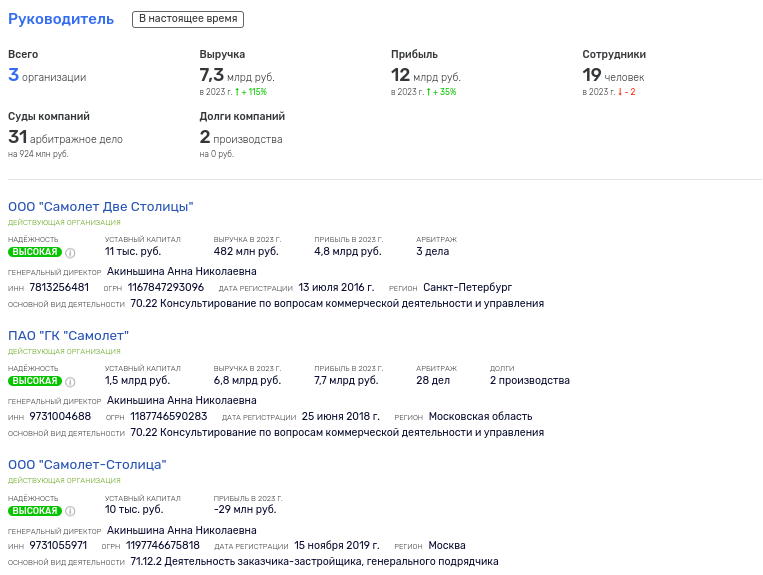

In late November and early December 2024, Anna Akinshina became the general director of three legal entities of the division at once, including PJSC Airplane Group of Companies, Airplane Two Capitals LLC and Airplane-Capital LLC, where Maxim Vorobyov has shares.

Photo: rusprofile.ru

Akinshina, a native of the Sberbank division, previously headed Sber Eapteku.

Apparently, the appointment of Akinshina is an attempt to support the falling pants of the Civil Code with the money of the state bank. After all, it was Grefovsky Bank that credited the construction of the Samolet, therefore it is most interested in keeping the developer from falling to the bottom.

And Akinshina is called a possible person of Lev Khasis, who was also related to the top management of Sberbank.

In 2022, Hasis broke the contract with the bank and left for the United States, having citizenship. A year ago, it was Khasis who became the first Russian to be removed from sanctions by Great Britain. For any such services, sanctions were lifted from Khasis, it was not specified.

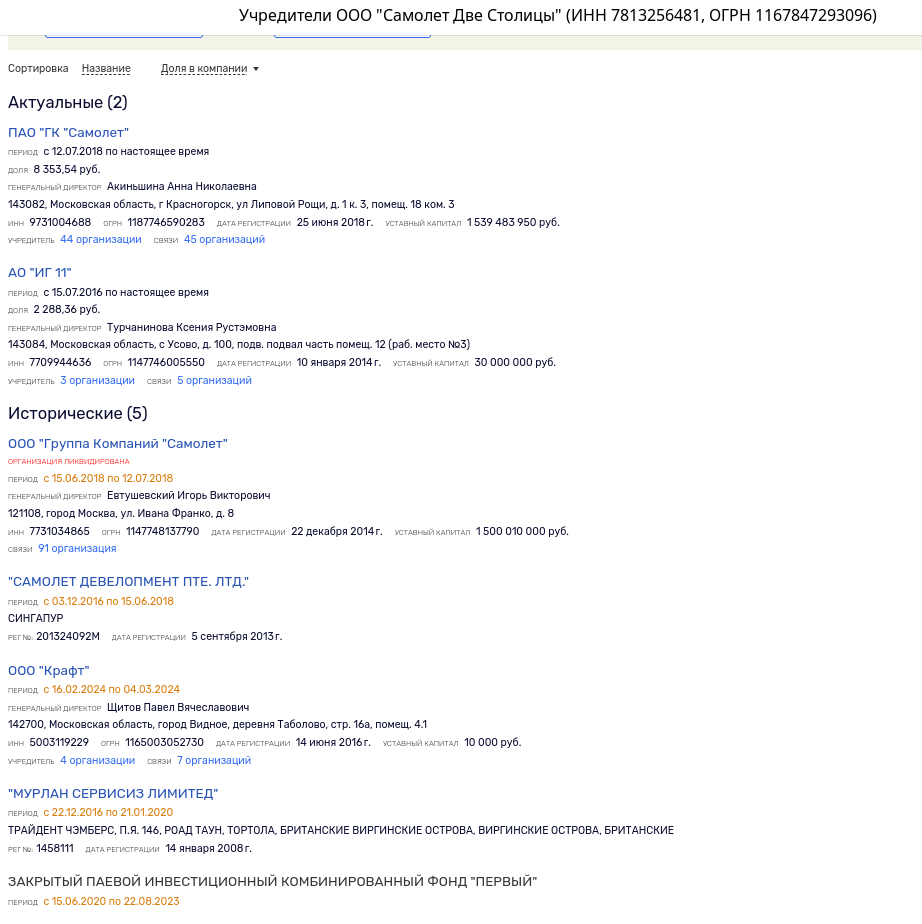

Funny: in LLC "Airplane Two Capitals," on which Akinshina was put, previously also inherited a seasoned offshore - "MURLAN SERVICES LIMITED" from the British Virgin Islands. And at the same time, both the parent PJSC GK Samolet and the Vorobyov JSC IG 11 owned shares in the company. This hints to us about the possible beneficiaries of the offshore. Isn't the division's loan funds there?

Photo: rusprofile.ru

The general situation in the construction market, including those associated with the tightening of mortgage nuts and a corresponding drop in demand, against the background of existing financial indicators, has already put the Samolet in a steep peak. No matter how you have to make injections from budget billions, so as not to get a new wave of deceived equity holders.

But the presence of offshore companies in the history of the division causes concern - later these injections would not have to be collected from foreign money boxes.

-

.webp?v1735274132 800w) Crocodiles tears "Samolet" will consider the Prosecutor General's Office

Crocodiles tears "Samolet" will consider the Prosecutor General's Office

-

.webp?v1731299587 800w) Every Nisanov has his own Avdolyan

Every Nisanov has his own Avdolyan

-

.webp?v1729652389 800w) Fight in Lyublino: Nisanov grows with Avdolyan

Fight in Lyublino: Nisanov grows with Avdolyan

-

.webp?v1729225030 800w) Related in a row Goda Nisanova: billions undercover

Related in a row Goda Nisanova: billions undercover

-

.webp?v1724041550 800w) "Samolet" enters Koltsov, equity holders get ready

"Samolet" enters Koltsov, equity holders get ready

-

.webp?v1719289532 800w) "Independent" capitals of Khikhinashvili "will serve" God Nisanov?

"Independent" capitals of Khikhinashvili "will serve" God Nisanov?

.jpg?v1735015368)

.jpg?v1735015368)