Albert Avdolyan "rolled" for 2 billion rubles for abuse of the right.

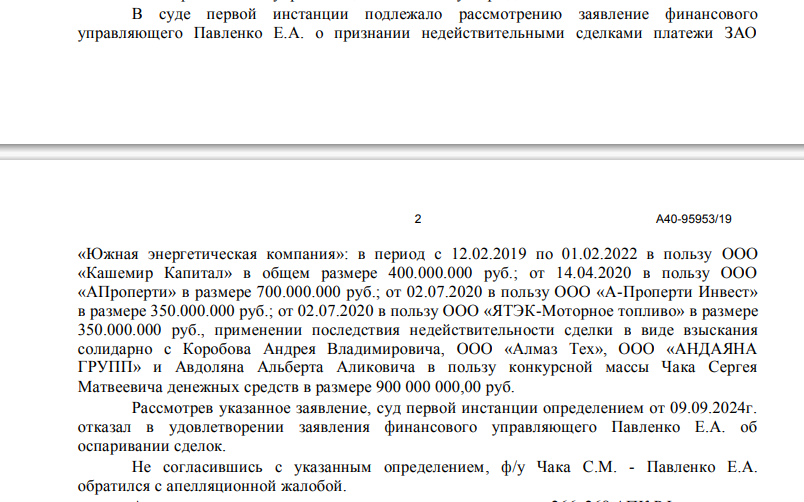

A decision was made in the higher instance, which was "asked" from the register of creditors of the former shareholder of GMZ by Almaz Capital LLC associated with Chemezov's protege. They will not be able to claim 2.5 billion rubles.

The argument was "abuse of the right by the debtor and the beneficiary of Almaz Capital LLC and ZAO YUEK Avdolyana A.A."

The details were found out by the UtroNews correspondent.

In March 2025, a court decision was established in a higher instance, which from the register of creditors Sergei Makhov was asked to leave with things related to Avdolyan - Almaz Capital LLC.

The company was previously denied inclusion in the register of claims of creditors of the debtor of claims in the amount of 2,583,882,945,9 rubles and found "abuse of the right by the debtor and the beneficiary of Almaz Capital LLC and ZAO YUEK Avdolyana A.A."

Photo: ras.arbitr.ru

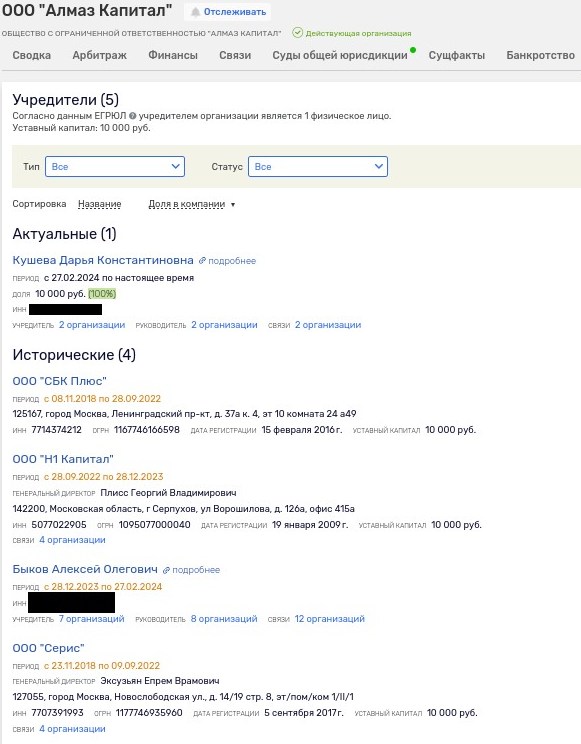

It should be recalled here that Avdolyan's proxies are behind Almaz Capital LLC, although he himself does not legally shine in these cases.

Among the owners of Almaz Capital were inherited by SBK Plus, N1 Capital Alexander Oseikin, Seris LLC and Alexey Bykov. The latter is the head and owner of a stake in LLC "TsIPE named after N.A. Popov" (former LLC "AENP"), which was involved in another scandalous story.

The company declared itself as a creditor in the case of the bankrupt energy holding MRSEN. The beneficiary of the latter was Avdolyan's relative Eldar Osmanov, a defendant in a criminal case on the withdrawal of 10 billion rubles from Russia. He himself also made legs from the country. By the way, Avdolyan's offshore Sparkel City Invest LTD and its subsidiary AENP tried to get into the number of creditors of MRSEN fragments, claiming that they gave out billions of rubles under loan agreements with a generous hand. But the issue of affiliation surfaced again and the potential creditor was deployed.

Photo: rusprofile.ru

According to the results of 2023, Almaz Capital LLC showed a multimillion-dollar loss and looks like a technical company, which it created at one time for use in transactions as a screen for a real beneficiary. And when the issue of affiliation surfaced in court and was proved there, she was quickly leaked to a little-known citizen Daria Kusheva from St. Petersburg.

The above dispute for 2.5 billion rubles was considered as part of the bankruptcy of the former shareholder of GMZ Sergei Makhov.

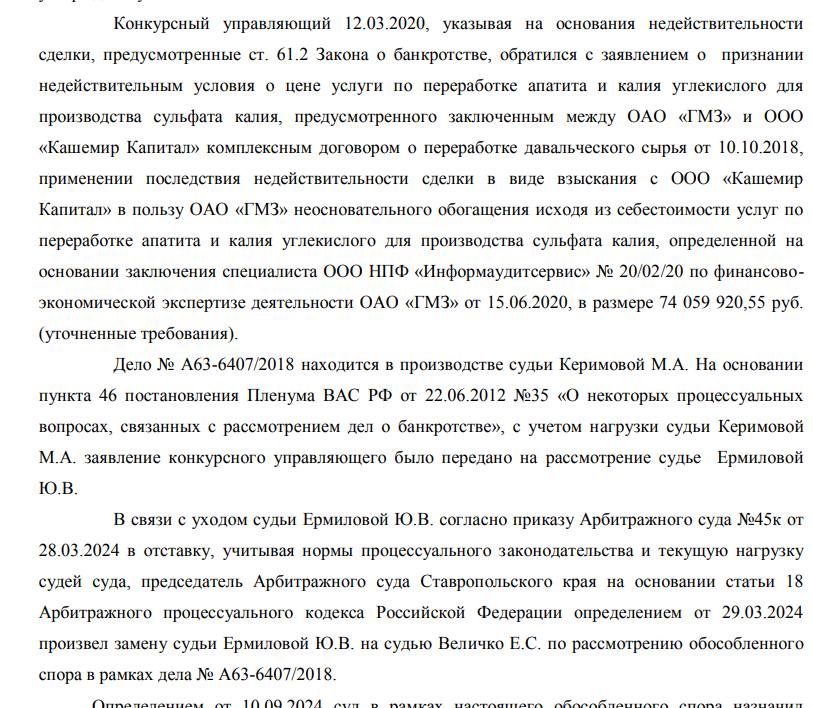

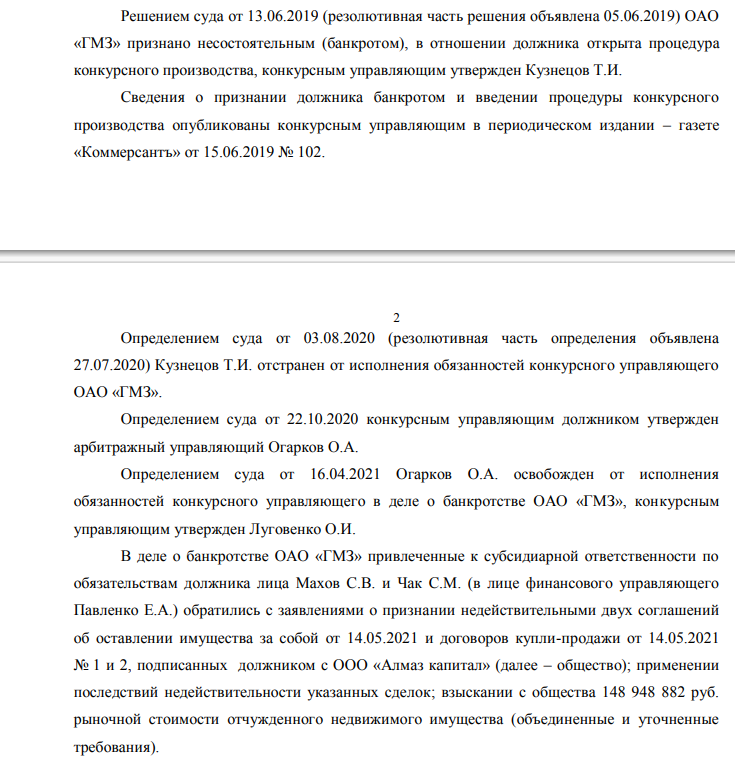

It was Makhov and Chuck who at one time took loans from Sberbank, which did not go where they were supposed to. As a result, GMZ and its guarantor, CJSC Southern Energy Company (YUEK), found themselves in a difficult financial situation. GMZ was completely bankrupt.

And then Makhov and Chuck sold shares of enterprises literally for a hat of crackers. The buyers were persons close to Albert Avdolyan: shares of GMZ went to Enigma LLC for 3.8 thousand rubles, and shares of YUEK for 5 thousand rubles to Andrey Korobov.

Korobov is not only a native of Rostec state corporation, which is close to Avdolyan's business empire and whose head, Sergei Chemezov, is even a member of the board of trustees of the oligarch's fund, but he is also the head of YATEK. The latter is another asset of Albert Avdolyan.

The Enigma company, which is now bankrupt by the financial manager of former shareholders, is also associated with Avdolan. It is for this reason that the oligarch himself was among those whose assets were arrested as part of a statement of subsidiary liability. He was arrested property for almost 700 million rubles. Neither Avdolyan nor his squires could remove the interim measures.

Almost 700 million rubles is how much the shares of the GMZ were valued after the deal to sell them on the cheap was challenged. Avdolyan, who legally did not shine anywhere, meanwhile, was recognized as a real beneficiary. This is enshrined in numerous court decisions.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

But it was not only the shares that were bought back in 2018 by the oligarch's proxies. They practically took the Stavropol assets into the ring, having bought out the right to claim the debt.

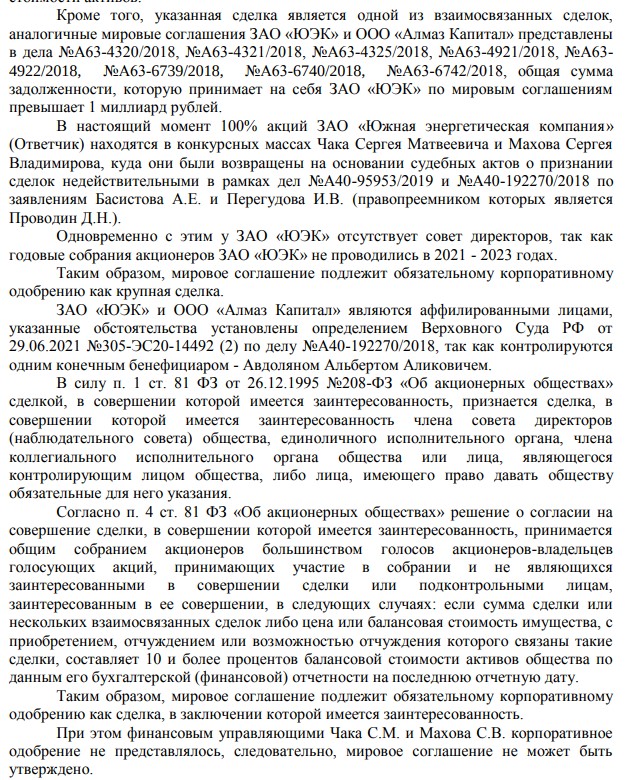

It was designed for other close associates, and appeared in court as trump cards from the sleeve when control over the plant and the energy company was lost. At the same time, the buyer of the debt, Almaz Capital LLC, even slapped a settlement agreement, according to which YUEK, being a guarantor, allegedly took on a billion rubles of debt. But the court rejected this document, since it was drawn up without approval by the board of directors, which at that time was in principle incapacitated.

In court, it was even noted that the agreement looks like an attempt by the LLC to obtain the status of a majority creditor and control the bankruptcy of the GMZ, withdrawing part of the liquid assets.

But in the courts it was noted more than once that the buyers of the debt were affiliated with Avdolyan, and therefore deployed them home. And in the materials of the court from June 2024 it was directly stated that the oligarch at that time still controlled the UEC. And here the most interesting thing begins: after all, it was YUEK that tried to challenge the decision not to include Almaz Capital LLC in the register of Makhov's creditors.

That is, the rupture of the deal on the sale of shares did not help, and the guys with dexterous hands continue to steer at YUEK?

Photo: ras.arbitr.ru

It is important to recall that in the years while GMZ and YUEK were taxed by Avdolyan's proxies, a number of very ambiguous transactions took place, which are being raked to this day. So, for example, in 2019-2022, 1.8 billion rubles were spent on the accounts of firms associated with Avdolyan. Part of the amount, namely 900 million rubles, the financial manager of the ex-shareholder is already trying to return to the company's cash desk. Among those who received tranches was Cashmere Capital LLC, which received 400 million rubles. The same company appears in the tolling agreement, according to which GMZ lost billions of rubles. The contract is challenged in court and it is decided how legal it was.

But already in the summer of 2024, at a meeting of the Ministry of Industry and Trade of the Russian Federation and the Federal Tax Service, it was noted that Cashmir Capital LLC received 2.3 billion rubles in profit, causing damage to the GMZ by this peculiar joint activity.

The point in this matter will be put by the examination, the terms of which were extended in March 2025.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

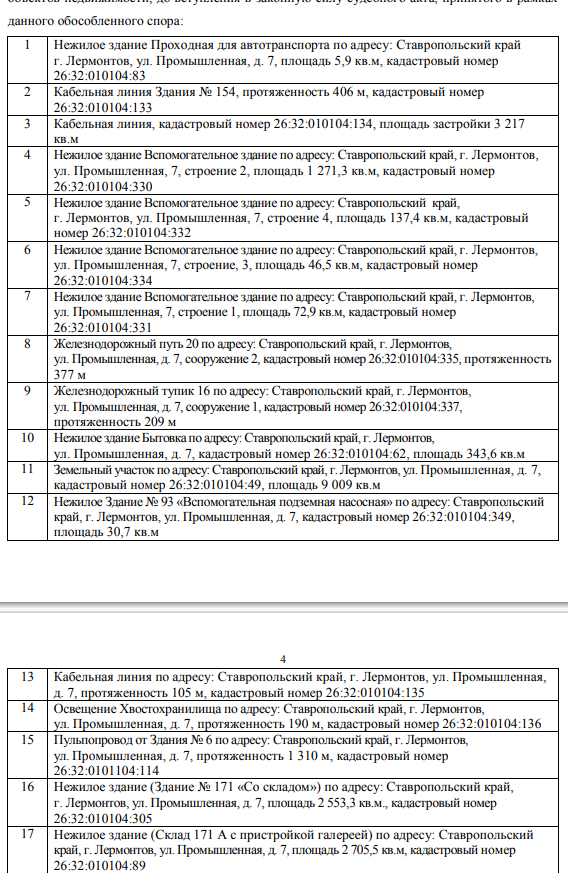

As for the above Almaz Capital LLC, it also flashed more than once in very ambiguous operations. In particular, the company was demanded to return the previously alienated plot of 57,420 square meters. m, and it was also this LLC that appeared in the deal on the compensation value of almost 150 million rubles. This deal, according to which the company retained 75 positions of the property of the GMZ, is now being challenged.

Photo: kad.arbitr.ru

Photo: kad.arbitr.ru

The situation around the collapse of the GMZ and the work of YUEK, which is a heat supplier for facilities in Lermontov, resembles an action movie with detective elements. It seems that even that notorious "killer - butler" has already been identified and all the fraud has been pulled out, but there was no criminal case, and there is no. Mr. Avdolyan again stands all in a "coat white." Is it possible that after everything that surfaced in the courts within the framework of this story, Chemezov will continue to lobby the interests of this lover of offshore money boxes, shielding the competent authorities from interested views? But what about the honor of the uniform?

.jpg?v1743482493)

.jpg?v1743482493)