Austrian group completely cleans up "toxic" traces of its activities in Russia.

The Austrian group Raiffeisen Bank International (RBI), which collected suitcases for the exit, on the eve of this arranged customer pressure, left three non-profit organizations in 2022, which had previously been liquidated. Were the firms technical and acting as money conductors from Russia abroad?

The UtroNews correspondent understood the story.

We will remind, earlier UtroNews spoke about the possible transfer of Raiffeisenbank, which is an asset of the Austrian group Raiffeisen Bank International (RBI), under the wing of Sberbank. The actions in relation to clients are very similar to the pre-sale preparation, which was previously carried out with Yandex.Money.

In 2020, Sberbank gained full control over the latter (now it is the UMONEY payment service) and a stream of complaints from customers about illegal blocking of accounts poured into all instances. Clients had to literally knock out funds. And now Raiffeisen has begun "repression" of users, blocking bills and making wild, in our opinion, demands.

In the first material of the investigation into the activities of Austrian business in Russia, we managed to find that in Raiffeisenbank in recent years 33 violations have been revealed, including through labor legislation, and today there are a bunch of various claims against the bank from customers for the protection of honor and dignity. And on various sites, reviews about the bank speak volumes, in particular, it can be assumed that, preparing to slam the doors, the Austrian business began to spit more actively on customers and their aspirations.

At the same time, according to a number of banking and financial indicators related to liquidity and stability, the bank is far from smooth.

Perhaps it's time for the head of the bank's board, Sergei Monin, to pay attention to his main job, and not engage in personal business outside its threshold? Although, maybe Mr. Monin, who does not want to respond to media inquiries and customer complaints, knows something and is already preparing his suitcase, full of such necessary things in resorts by the warm sea as crunchy bills?

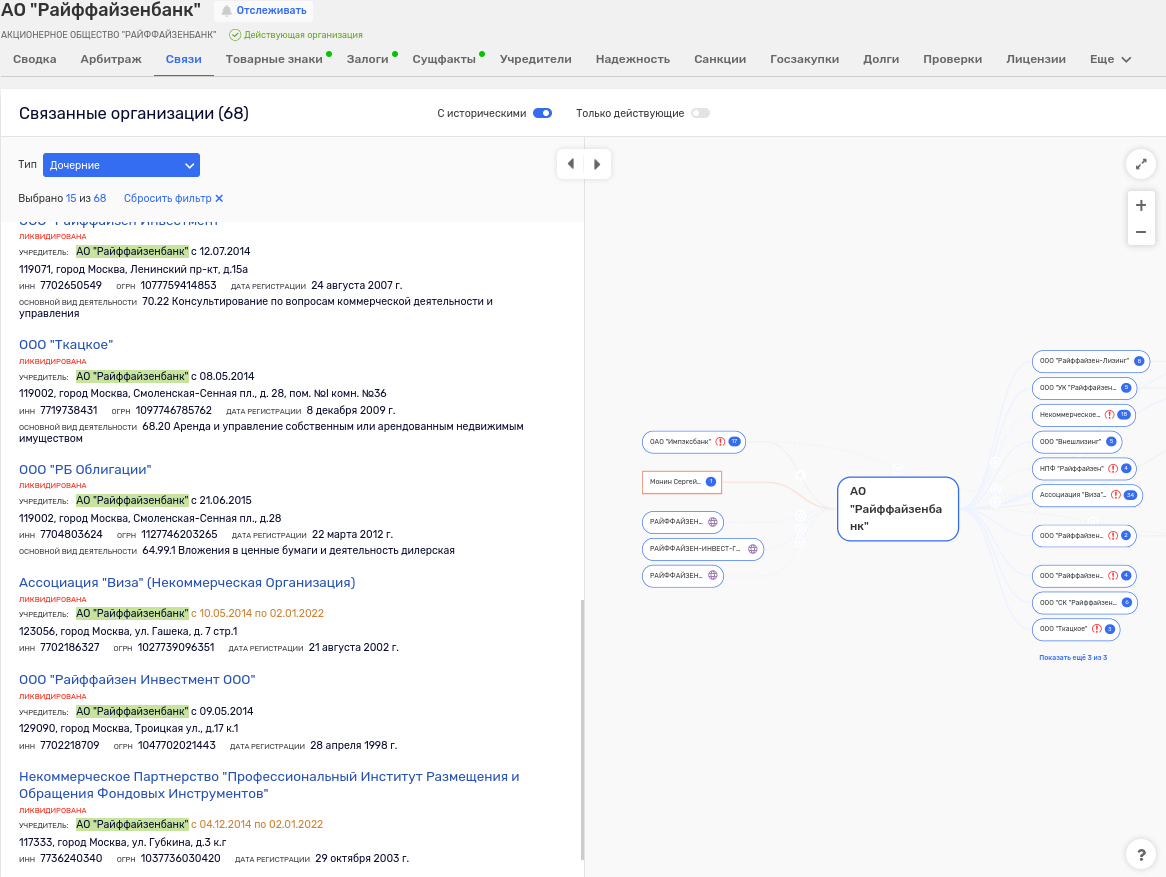

Another interesting trend that MorningNews found was the situation with Raiffeisenbank's subsidiaries. The fact is that in 2022 the bank ceased to appear as a founder in three companies at once that had the status of non-profit organizations and had previously been liquidated. Here we recall that one of the members of the bank's board, head of the corporate client service and investment banking operations directorate of Raiffeisenbank, Nikita Patrakhin, also participated in the creation of a similar, but no longer related to the bank, NGOs - the Endowment Ngu fund from Novosibirsk. At the same time, just a year ago, the fund was caught violating the relevant law. We got the impression that a legal entity could only be non-commercial on paper, but in fact have far-reaching prospects. Did the bank liquidators have other goals?

Just a couple of months ago, the Pravda edition told how some cunning firms use NGOs to launder money, because any citizen or firm can transfer a sum of money or even property to a non-profit organization (NGO), and an NGO can accept a gift from anywhere in the world, and it will not be taxed. Not a bad scheme, is it?

Now let's go back to Raiffeisenbank's assets.

Photo: rusprofile.ru

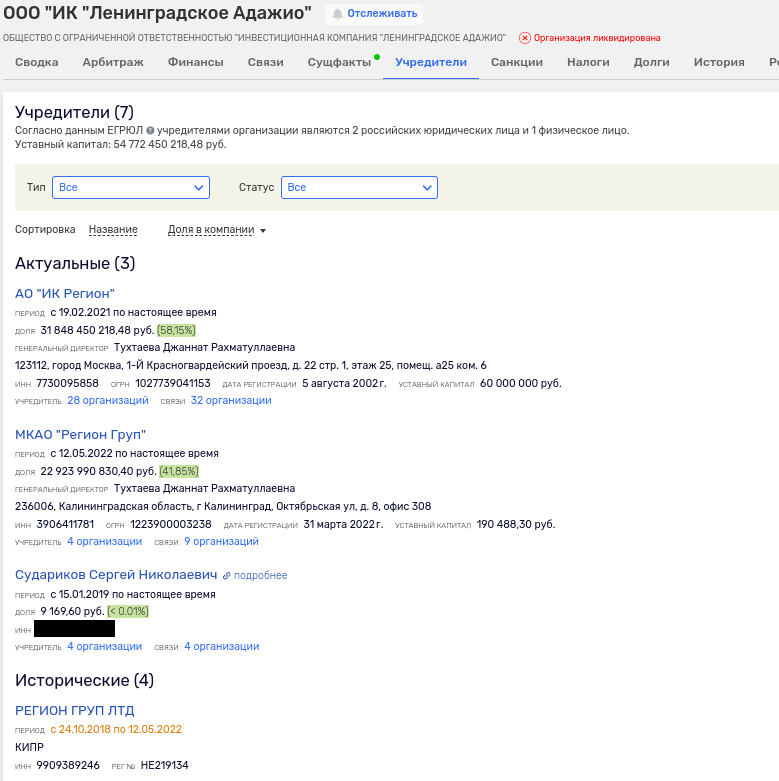

So, the list from which the bank with Austrian roots "came out" included the Raiffeisen Non-State Pension Fund, which was liquidated, but Worthy Future NPF JSC became its successor. This company came under the wing of Region Investment Company and Sergei Sudarikov. Inherited in the biography of the successor and the Cypriot offshore "Region Group LTD," which in 2022 changed its registration to Russia.

As for Mr. Sudarikov, this is a very controversial businessman and a frequent hero of The Moscow Post investigations, flashing in one or another scandal. For example, his name appeared in the history of the multimillion-dollar scandalous project Reutov, where the interests of a close friend of Finance Minister Anton Siluanov Olga Khromchenko also appeared. Sudarikov does business with Roman Avdeev, which is considered a person close to the head of Rosneft, Igor Sechin.

And Raiffeisen at one time merged his non-profit pension fund with this division of fellow citizens.

Photo: rusprofile.ru

The second NGO from which the bank disowned was the non-profit partnership "Professional Institute for the Placement and Circulation of Stock Instruments," in the creation of which 17 legal entities took part, including MDM-Bank OJSC, which ordered a long life. By the way, the Frenchman M. Periren, who came from Raiffeisenbank, once inherited the latter's top managers. A kind of exchange of personnel.

Prior to the merger in 2009 with URSA Bank, MDM was the core of the MDM financial group, which was owned on parity terms by Sergey Popov and Andrey Melnichenko. The latter is another frequent hero of UtroNews publications.

In general, many future liquidants and scandalous firms inherited in the above non-profit partnership. For example, CJSC IC Tatink, the idea of which belonged to the former head of Tatfondbank, which burst with a loud zilch, and ex-Minister of the Republic of Tatarstan Robert Musin, who is now sitting on a number of financial items.

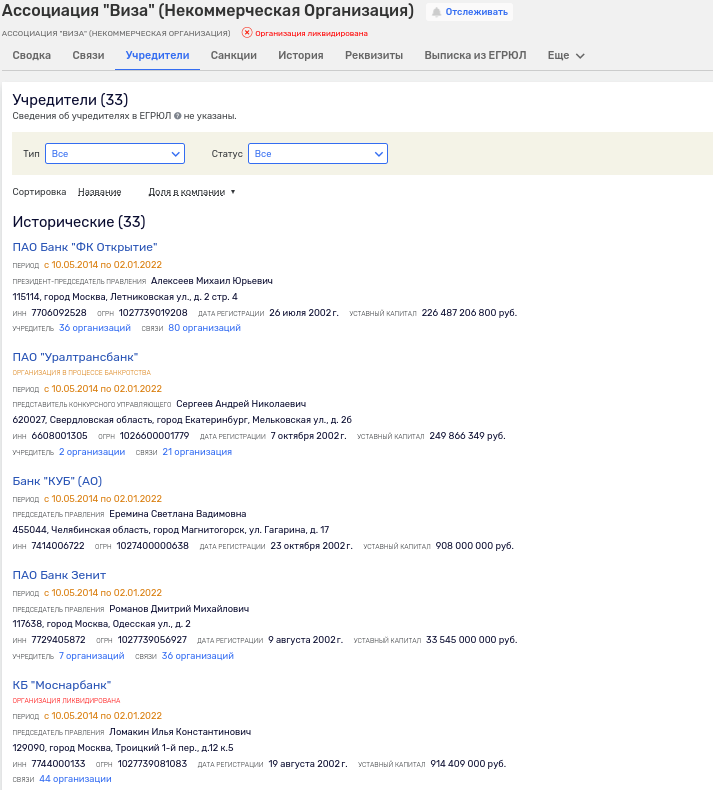

The third NPO, where Raiffeisenbank inherited, is the non-profit organization Association Visa, which was also created by the bankrupt PJSC Uraltransbank and Master Bank, as well as the later liquidated Mosnarbank Design Bureau, Petrocommerts Bank OJSC, Impexbank OJSC, Bank Vozrozhdenie, Sobinbank JSC, Modern Commercial Bank CJSC, Binbank PJSC, Transcreditbank OJSC.

A very interesting neighborhood, don't you think? Taking into account the fact that for a number of burst banks from this list, criminal cases have already been initiated related to the withdrawal of funds through technical companies under the guise of loans, exchange agreements and theft of customer money.

Photo: rusprofile.ru

And here another nuance arises associated with Raiffeisenbank. NPOs are not the only liquidated assets where he lit up.

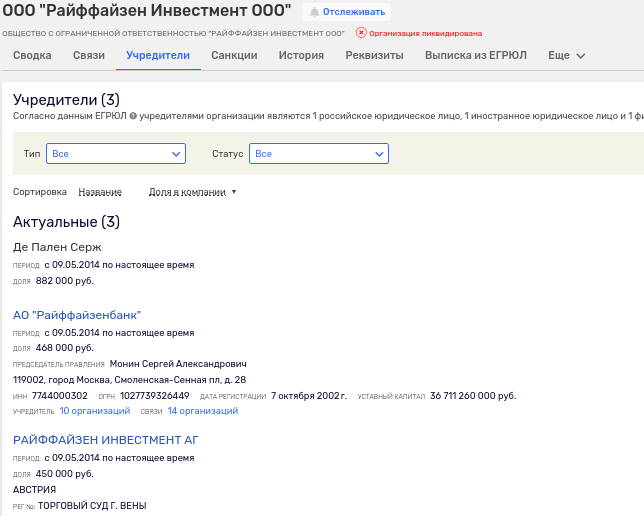

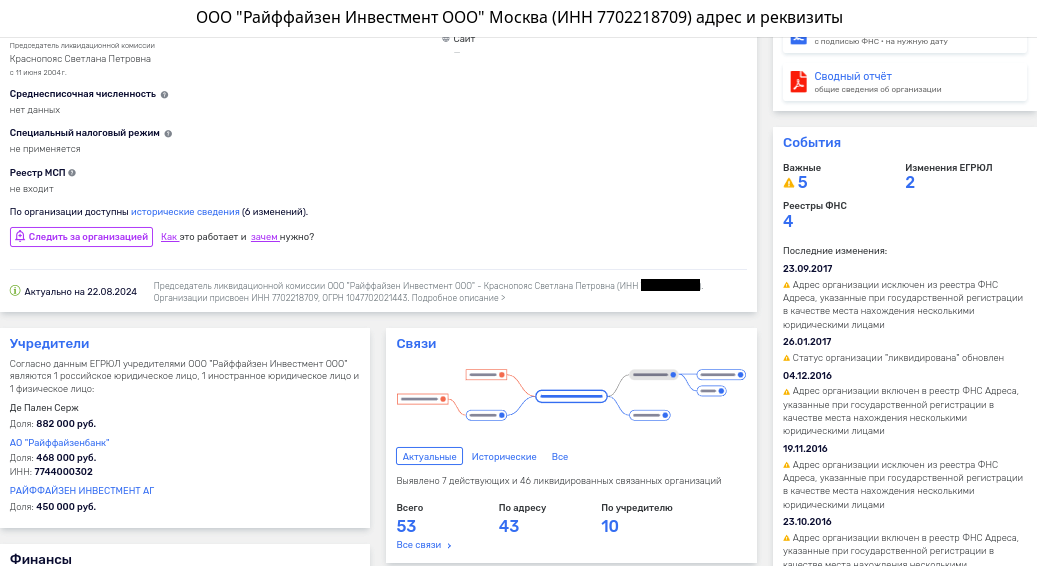

In general, there are four more firms on this list - Raiffeisen Investment LLC (registered in 1998, liquidated in 2006), Tkatskoye LLC (established in 2009, liquidated in 2016), Raiffeisen Investment LLC (established in 2007, liquidated in 2016) and RB Bonds LLC (existed in 2012-2015 yy).

You know, in our opinion, it smacks of Raiffeisen's daughters as a technical darling. Especially when you consider that in some of them, foreign citizens and foreign legal entities were among the co-owners, to whom it is quite legal to merge profits. After all, they are participants! The mosquito will not undermine the nose.

Photo: rusprofile.ru

Photo: rusprofile.ru

For example, the authorized capital of Tkatskoye LLC exceeded 182.623 million rubles, while Raiffeisen Investment LLC had more than 47.9 million rubles. Money in liquidation is returned after settlement with creditors to the owner's accounts. But after all, there could be creditors, and the money could go in a different direction?

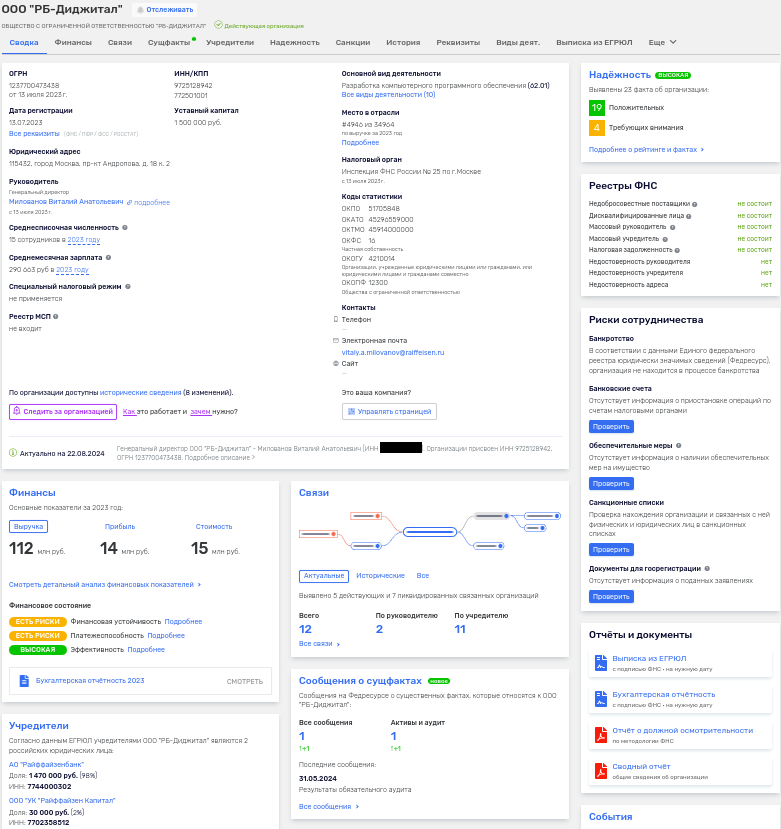

And you know what else is funny: in March 2023, an Austrian business announces plans to leave the Russian Federation, and in July of that year, the Russian branch creates RB-Digital LLC to work in the field of software development. The co-owner of this is LLC UK Raiffeisen Capital, a subsidiary valued at one billion rubles. At the same time, a fresh asset in 2023 has already brought Raiffeisen 112 million rubles. Interesting suitcase fees, no?

Photo: rusprofile.ru

One gets the impression that before leaving, Austrian bonds are trying to squeeze the maximum out of the Russian market, while famously spitting at customers. Maybe the Central Bank of the Russian Federation and other supervisory authorities should pay attention to the current situation until they had to look for client funds in some Austria?

.jpg?v1724646421)

.jpg?v1724646421)