The Russian primary housing market is overheated, prices remain ultra-high, but is everything so bad that the country's main developer Samolet is forced to get rid of tasty assets?

Or is it due to his business problems? The UtroNews correspondent understood the twists and turns of the plot.

"Samolet" went on hand

The leader of the Russian real estate market, the developer Samolet, decided to part with 12 land plots of 26.9 hectares in the Filimonkovskoye settlement in New Moscow, which previously housed the Maryinsky poultry farm. Vedomosti determined this fact by analyzing the data of the Sberbank-AST electronic platform.

Bidding for the lot will be held at the end of July, according to documents, 272,185 m of real estate ² can be built on these plots, including 152,664 m2 of housing. It would seem that a tidbit on the main real estate market in Russia, but the developer still sells assets under the auspices of "maximizing income from the development business," this is how the press service of Samolet explained the actions of the management.

Forbes, assessing this news, referred to the imminent changes in the real estate market associated with the cancellation of the mortgage "State Program 2020" from July 1, 2024 (it is also state support 2020). According to it, Russians could once take an apartment in a new building on a soft loan with a rate of no more than 8% per annum.

Photo: http://sdom31.ru/node/981

The key rate of the Central Bank is now at around 16% and due to problems with inflation is in no hurry to decline, which means that the cost of a standard mortgage will not be lower than 18-19%.

Thus, the abolition of the basic preferential program will really hit the market, but still it lives not only by the "State Program 2020," which was already cut a year ago. There is also an IT mortgage (a preferential rate of 5%) and a family mortgage (6%), due to the latter everything continues to hold on.

Suspicious successes

"Samolet" recently disclosed operating results for 5 months of 2024, from which it turns out that the developer is doing well from a formal point of view. The volume of sales of primary real estate increased by 66% to 132.5 billion rubles, the number of contracts concluded increased by 28% to 17.8 thousand, and the average price of an apartment became 24% more expensive, reaching 218.2 thousand rubles per meter.

The share of mortgage loans in the portfolio reaches 75%, but thanks to the family mortgage, it does not hit the company catastrophically.

It turns out that the cancellation of the "State Program 2020" is hardly the motivation of "Samolet" in refusing to build 12 plots in the new Moscow region, where the metro will soon be opened.

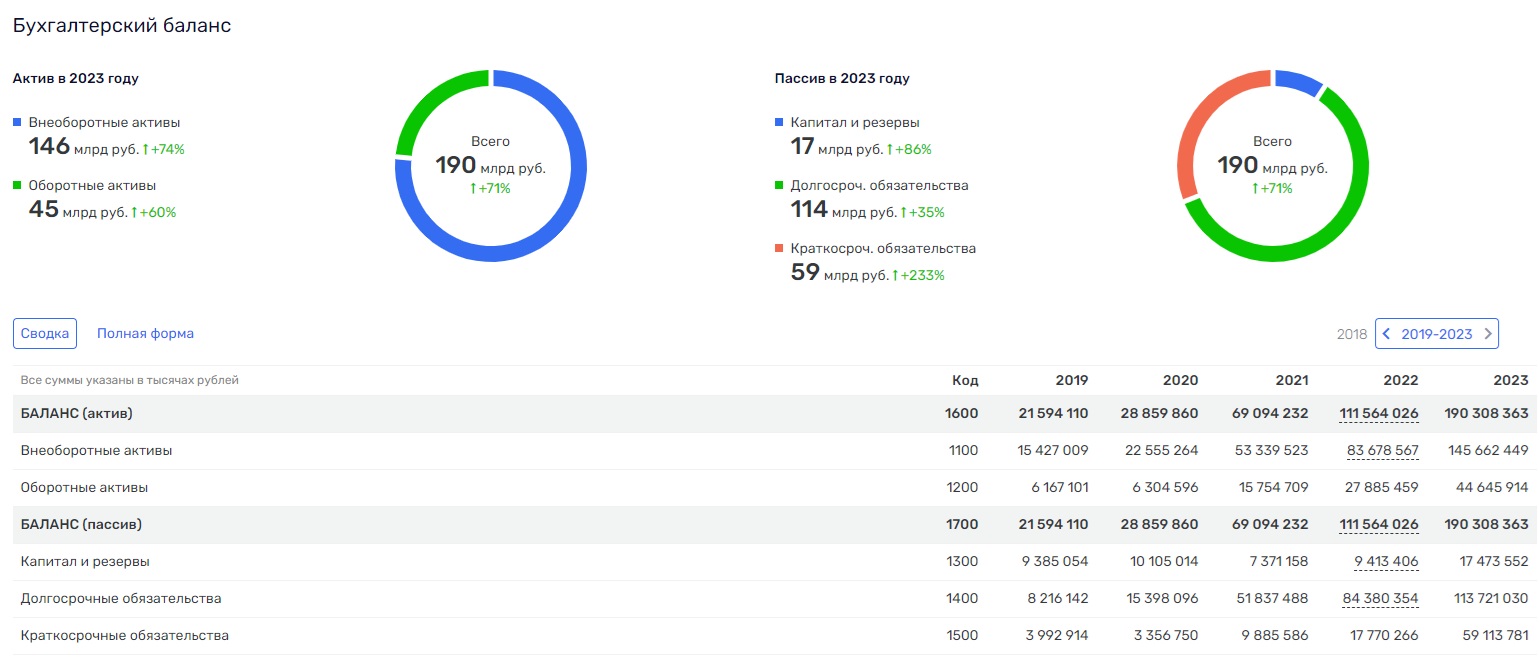

Photo: rusprofile

The value of Samolet shares for 2024 fell by 19%, despite the growth in revenues, sales and other gross indicators. For an organization that works in the real sector of the economy, this indicator is not so important, but it rarely falls with such a declared financial growth. All this hints at the presence of a double bottom in this story.

By the end of 2025, Samolet planned to launch 48 new projects in 12 regions of the country, its nominal profits are constantly growing, and here the company refuses a fat piece in Moscow. Something doesn't add up here.

Card house out of debt

The casket turns out to be simple: debts are pressing on the "Samolet." The net corporate debt of the developer at the 31.12.2023 of the year amounted to 75.9 billion rubles. Last year, neither the growth of turnover nor the record net profit of 26.1 billion rubles coped with this problem.

The company's short-term liabilities are estimated at 59 billion rubles, long-term - at 114 billion rubles with capital and reserves of 17 billion rubles and current assets of 45 billion rubles.

Photo: https://litmap.ru/kak-postroit-kartocnyj-domik/

The problem of "Samolet" is that business of the company is constructed on debts which allowed the developer to buy up every year new assets and to increase scales of construction. In 2019 the net debt of the company grew five times, and for the next four years it increased still six times in the superheated, completely depending on mortgage programs market. The situation reminds the card house when any whiff of a breeze is capable to disorganize a design.

If suddenly sales of "Samolet" drop, let us assume, by 20%, and market prices of new apartments will begin to stagnate or fall, then the net profit of the developer will be below zero, and it will become a sentence for the structure ground on borrowed funds and absorption of competitors. In October of last year "Samolet" redeemed 100% of shares of other builder from Alexander Kopylkov, having spent for it 45 billion rubles.

News signal about problems of "Samolet" long ago: the board of directors of the company recommended not to pay to shareholders dividends for 2023, the organization continues to sue the former top manager who ran across to competitors from Dogma, and her shareholders tried to storm the sales office of ZhK "Hills Park" in Vidnoye.

Introduction of escrow accounts reduced sharpness of a problem of defrauded investors, but didn't move away her completely. Builders are capable to delay delivery of keys and to create other problems, and it happens also to the leader of the market by "Samolet", and, above all that in case of crash of the developer by the legislation will close all questions the state.

Beneficiaries

The analysis shows that business of "Samolet" looks like a financial "MMM" pyramid, only instead of actions the bank credits and money of investors here. Every year the developer bought new assets and received new objects, constantly increasing debts and a turn, and now when in the real estate market there occurs recession, all processes slow down and debts fall down the company.

Only as so it turned out that the leading developer of the country on check was such friable structure? We already wrote that "Samolet" is connected with family of the governor of the Moscow region Andrey Vorobyov. His brother Maxim owns 25% of stocks in the Samolet Two Capitals company, but, apparently, real influence of these people is higher.

Photo: https://sun9-26.userapi.com/impg/J_YH82q3PA1k454X3VJXDGE4CpxAdD39Ci626w/XRgJ5SCu45k.jpg? size=1000x667&quality=96&sign=f3337d1b51daaaf98bd265b99d9d31a9&c_uniq_tag=mOSQSK5oI21Nf9ggCGOf7uuwi57s5ZRH8H_60yVp6e0&type=album

In 2022 the God Nissans which is Andrey Vorobyov's adviser on a voluntary basis became the minority shareholder of "Samolet". Nisanov's company "Red Square" was one of leaders of the market of housing construction of Moscow even before emergence of "Samolet", but, despite this, he entered the capital of the competitor then that began to grow quickly.

On wave of a magic wand or by someone's council of Nissans became the participant of the project who took the first position in the Russia construction market.

Earlier being owner of SDI Group Ilgar Gadzhiyev accused Nisanov, Vorobyov and the Mayor of Moscow Sergei Sobyanin that they took away from him business and threatening with physical abuse forced to pay money to the Moscow region governor. For this reason he in several developer projects was forced to become the partner of relatives of Nisanov and because of it allegedly lost everything. Now Gadzhiyev lives abroad, and against him in Russian several criminal cases are brought.

It wasn't here and without "a foreign element" acting through the president of Azerbaijan Ilham Aliyev whom Gadzhiyev called Nisanov's business partner and the lobbyist of his interests in Russia.

The interest of the leader of Azerbaijan in the Moscow real estate is confirmed by his family relations with Agalarov' family – other developers from Baku which ill-fated Crocus City Hall belongs therefore Nisanov and Aliyev's commercial interaction is a real plot.

However on the agenda not external financing of "Samolet", but the possible crash of this soap bubble capable to result in domino effect in the real estate market and in all Russian economy. On builders thousands of the enterprises in which hundreds of thousands of people work, not to mention the investors who decided on mortgage servitude in hope through torments to receive own living space are tied.

Whether the profile Deputy Prime Minister Marat Khusnullin and Sobyanin's mayor's office has a plan of "B" for such case or nominal excess profits of "Samolet" dim eyes to officials? If business so, then it is sad, it is necessary to think of the people once.

-

.webp?v1735274132 800w) Crocodiles tears "Samolet" will consider the Prosecutor General's Office

Crocodiles tears "Samolet" will consider the Prosecutor General's Office

-

.webp?v1735015368 800w) "Dead loop" Samolet: assets "withdraw" through the purchase of legal entities?

"Dead loop" Samolet: assets "withdraw" through the purchase of legal entities?

-

.webp?v1731299587 800w) Every Nisanov has his own Avdolyan

Every Nisanov has his own Avdolyan

-

.webp?v1729652389 800w) Fight in Lyublino: Nisanov grows with Avdolyan

Fight in Lyublino: Nisanov grows with Avdolyan

-

.webp?v1729225030 800w) Related in a row Goda Nisanova: billions undercover

Related in a row Goda Nisanova: billions undercover

-

.webp?v1724041550 800w) "Samolet" enters Koltsov, equity holders get ready

"Samolet" enters Koltsov, equity holders get ready

.jpg?v1718857305)

.jpg?v1718857305)