The oligarch Albert Avdolyan and those close to him who could be the authors of the scheme for the withdrawal of credit funds from the Hydrometallurgical Plant were given a ride in court. The lender was denied claims for 1.2 billion rubles.

But attempts to enter the register of a bankrupt enterprise, from which billions of rubles have sailed into the unknown, are not lost by companies close to the billionaire.

Details in the material of the correspondent UtroNews.

Recall that a big fan of offshore companies and doing business with the connection of a "cover" from "his people" Avdolyan in 2018 bought the Stavropol OJSC Hydrometallurgical Plant (GMZ) for the production of fertilizers. Affiliated CJSC Southern Energy Company went to it, which supplies heat and electricity to the city of Lermontov, as well as Intermix Met LLC. At the same time, assets were bought not in the name of Avdolyan, but on proxies. And four years later, the asset was sold.

The Kommersant newspaper in 2022 announced the deal, citing the oligarch himself, that "the enterprise was lifted from ruins and nothing threatens it." But the analysis of the situation around these assets, in our opinion, shows a slightly different picture. In fact, liquid property could be withdrawn to new legal entities, while GMZ and YUEK were left with debts worth billions of rubles. And the cherry on the cake is that among the new creditors of these legal entities, faces close to Avdolyan were drawn.

We continue to talk about what schemes have been tested in the Stavropol Territory on strategic assets.

In June 2024, the Moscow arbitration refused to include Almaz Capital in the register of creditors of YUEK CJSC, which acted as a guarantor under the GMZ loan agreement, claims for 1.2 billion rubles. At the same time, part of the amount - 218 million rubles, the company was still paid through the sale of the assets of the bankrupt GMZ, although the public has questions about the appearance of these debts.

Photo: ras.arbitr.ru

So, in 2011, GMZ borrows 1.6 billion rubles from Sberbank under a non-revolving credit line scheme, then this debt goes to the bank's subsidiary, SBK Plus LLC. In the same period, CJSC Southern Energy Company (CJSC YUEK) acted as a guarantor for the loan.

And in November 2018, a legal entity from the Gref division concludes an agreement on the assignment of claim rights for the remaining amount of debt - 1.4 billion rubles with a certain Almaz Capital LLC. At the same time, the capital of GMZ and related firms includes Avdolyan's team. The courts have repeatedly proved that both Almaz Capital and ZAO YUEK have one ultimate beneficiary - Albert Alikovich Avdolyan.

Photo: ras.arbitr.ru

The story itself with the debt also has an interesting development, almost detective.

In December 2022, Almaz Capital sent a pre-trial claim to YUEK to pay the debt on the GMZ loan - more than 1.48 billion rubles. The money was not credited to the account, and the LLC went to court, but here the most interesting details surfaced.

As specified in the court materials, UEC shares today are in the competitive masses of Chuck Sergey Matveevich and Makhov Sergey Vladimirov - former owners, even before Avdolyan. They were returned to the bankruptcy estate by the decision of the courts in the framework of bankruptcy cases of these individuals at the request of their creditors.

The judges stated that the surety of ZAO "YUEK" on the debts of the plant was economically inexpedient, since there was an inappropriate spending of funds. Both the lender and the guarantor were controlled by Makhov and Chuck until 2018.

The loan was taken under the pretext of financing the costs of technical re-equipment of OJSC GMZ, but the work was not carried out, and in 2019 the plant became completely bankrupt.

The court noted that "there is no evidence of the targeted spending of funds on the loan in the case file," and "if the shareholders of YUEK CJSC had deliberately pursued goals aimed at the development and modernization of GMZ OJSC, at the real implementation of technical re-equipment measures, and as a result, at increasing profits, then GMZ OJSC would not have suffered bankruptcy, its solvency remained at a high level"

The court considered that for the defendants the purpose of the loan agreement and the surety agreement "was the illegal withdrawal of credit funds, without any intention to return them to the bank."

Photo: ras.arbitr.ru

Among other things, the creditor was reminded of the omission of the statute of limitations.

Moreover, in a court decision of June 2024, it was stated that CJSC YUEK is still controlled by A.A. Avdolyan and cannot be interested in the application for missing the statute of limitations, since there is reason to believe that it pursues unfair goals to increase debt to the controlled company. Translated into understandable language - a pocket of one coat drives a pocket of the same coat into debt in order to control bankruptcy.

Photo: ras.arbitr.ru

Covering the tracks?

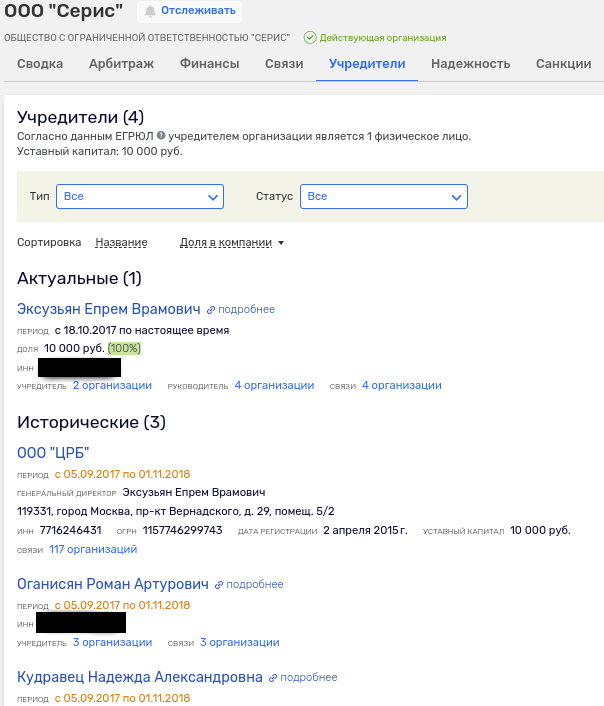

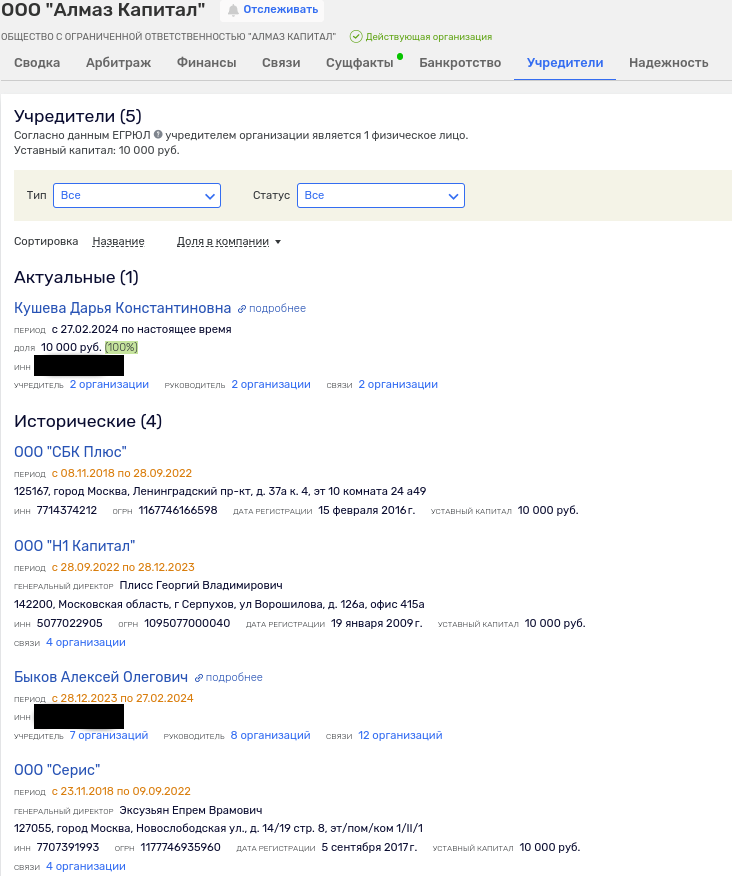

Almaz Capital changed hands: from SBK Plus LLC to a certain N1 Capital LLC Alexander Oseikin, as well as to Seris LLC and Alexei Bykov. The latter is directly related to AENP LLC (today - N.A. Popov CIPE LLC), which tried to get into many financial disputes and operations of the division of the bursting energy holding MRSEN. The beneficiary of the latter was the businessman Eldar Osmanov, who was now running away from the investigation, at that time a relative of Avdolyan. Both AENP and the related Cypriot offshore Sparkel City Invest LTD tried to become one of the creditors of MRSEN, which in the eyes of the public and other creditors looked like an attempt to remove part of a relative's assets from the blow.

It is noteworthy that both the offshore Sparkel City Invest LTD and other employees of the oligarch's division, for example, the head of YATEK Andrei Korobov, and Dmitry Gordovich's BBR Bank, appeared in the GMZ deal. With the latter, the oligarch appeared in the story of the transfer of 100 million rubles to offshore firms to the Latvian bank JSC Citadele Banka.

But Almaz Capital, which played its role in 2024, was transferred to an unknown Daria Kusheva from St. Petersburg, who also became the owner of Almaz Innovations LLC in May 2024, which belonged to Eprem Exuzyan, another squire of the oligarch.

Exuzyan is also related to the aforementioned Seris LLC, which, as it turned out later in court, allocated funds to buy out GMZ debts from the banking structure. The buyer himself, created three weeks before the conclusion of assignment agreements with SBK Plus LLC, did not have the required 0.5 billion rubles. The money for the transaction came from the accounts of the already well-known BBR Bank.

Nadezhda Kudravets, a co-founder of Avdolyan's New House Foundation, which, moreover, already shone in other offshore oligarch schemes, also left its mark on Seris.

Photo: rusprofile.ru

All this leapfrog with resale (or more precisely, re-registration) is similar to an attempt to remove signs of affiliation for subsequent entry into the register of GMZ creditors. But judges are not fools in arbitrations, are they?

Photo: rusprofile.ru

Thus, we can observe the picture of how the team of the famous oligarch, close to the head of the Rostec state corporation Sergey Chemezov, actually lifted from the ruins of the GMZ.

.jpg?v1720412921)

.jpg?v1720412921)