The plane in distress, affiliated with the family of Governor Vorobyov near Moscow, seems to be pumped with state money through their people at the head of the developer's bank.

Another former employee of state banks appeared in the division of the Aircraft in distress - Arkady Tarnopolsky headed the bathhouse bought on the occasion of Bogachev. The biography of the new head of the bank is entirely state structures - from the Crimean RNKB to the Trust, which specializes in recovery, raising the market price and selling at maximum speed.

Against the background of financial problems, the Samolet division is being prepared for sale, not allowing it to fall to the bottom due to budget injections and controlling a possible exit to offshore?

The UtroNews correspondent understood the situation.

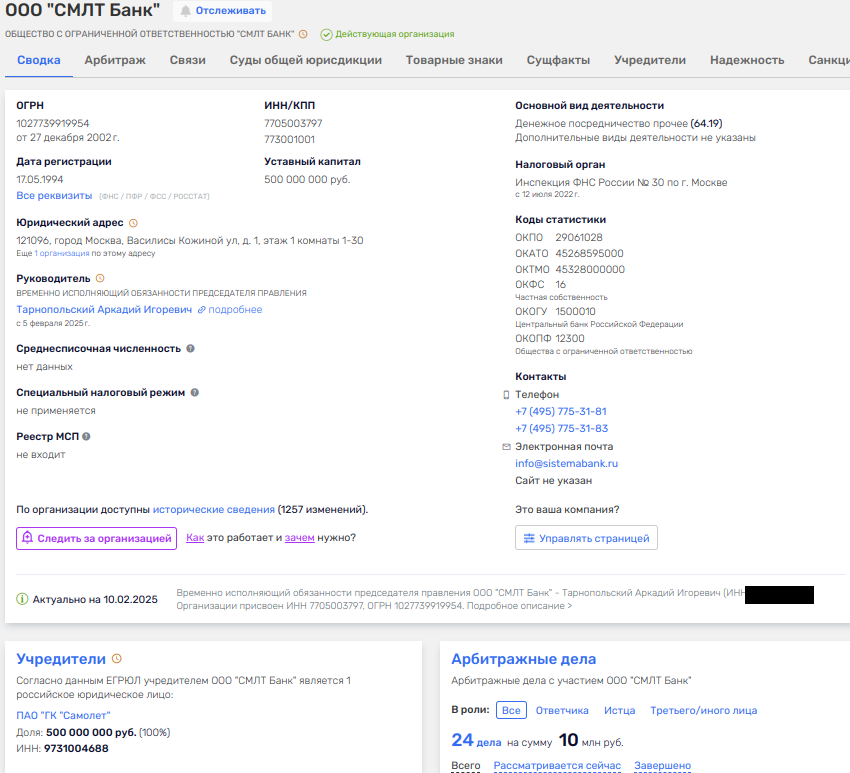

Since February 6, 2025, the acting chairman of the board of SMLT Bank LLC (formerly Sistema Bank) has been Arkady Tarnopolsky, who replaced Sergei Komissarov, who inherited from the former owner Alexei Bogachev.

Photo: rusprofile.ru

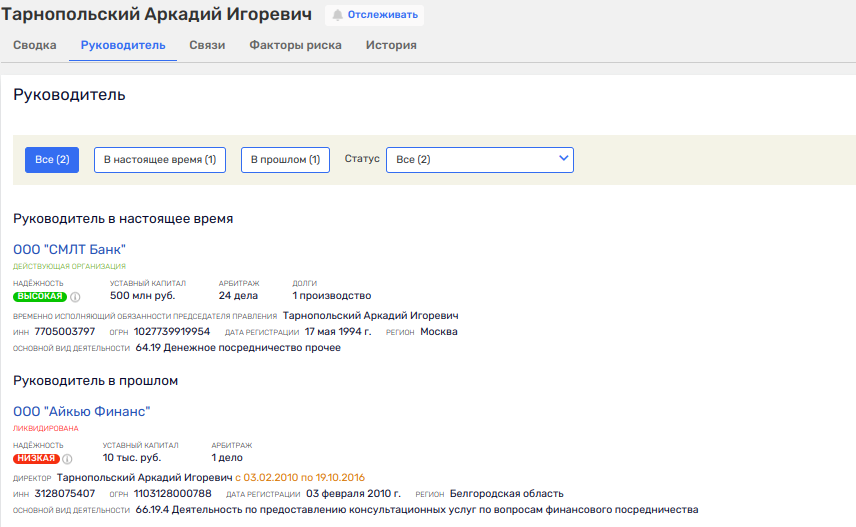

According to Rusprofile, Tarnopolsky was previously engaged in retail trade in non-specialized stores as an individual entrepreneur in the Belgorod region. He was also the director of Aikyu Finance LLC, which was liquidated in 2018, owned by Alexander Lagutin, the owner of the Crimean LLC Nmarket.PRO Crimea, which specializes in some services to business.

Photo: rusprofile.ru

From open sources it is known that Tarnopolsky was also the managing director of the mortgage of the RNKB bank in Crimea. Until 2016, this bank belonged to Comprehensive Energy Solutions LLC (CER), among the beneficiaries of which are Daria Demchenko, Alexey Baranov, Igor Lukashenko and Vladimir Kazintsev, but since 2016 the bank has been listed as state-owned.

Photo: realcongress.ru

In addition, the biography of Tarnopolsky indicates as a place of work and BANK ДОМ.РФ JSC - another state asset, which is part of the state corporation ДОМ.РФ JSC and occupies the lion's share of the market for project financing of developers. This bank has repeatedly credited the Samolet Group of Companies, moreover, Дом.РФ Bank with the Vorobyov division even has common mortgage projects.

Also, as we managed to find out from open sources, Mr. Tarnopolsky was among the top managers of Trust Bank - another state asset with very interesting specifics - on recovery, raising the market price and selling at maximum prices. Aren't they preparing the developer for sale through the new management?

Photo: e-xecutive.ru

When Anna Akinshina, a native of Sberbank, was put at the head of a number of the main legal entities of the Aircraft division, it was rumored that she could bring with her the money of German Gref's bank. Tarnopolsky is, in our opinion, another bell, and this time we can talk not only about budget injections, but also about preparing the asset for the next change of ownership. The same main shareholder and founder of the GC Mikhail Kenin, who managed to merge a small slice, seems to be ready to run to sign a sale and purchase agreement at least tomorrow.

Recall that GK Samolet became the owner of the bank exactly a year ago, having bought it from the infamous Bogachev. That the bank itself, that the former owner appeared in various kinds of MorningNews investigations. In particular, Bogachev was mentioned in an offshore story related to the withdrawal of funds, which also featured the ex-head of the FESCO board of directors Andrei Severilov.

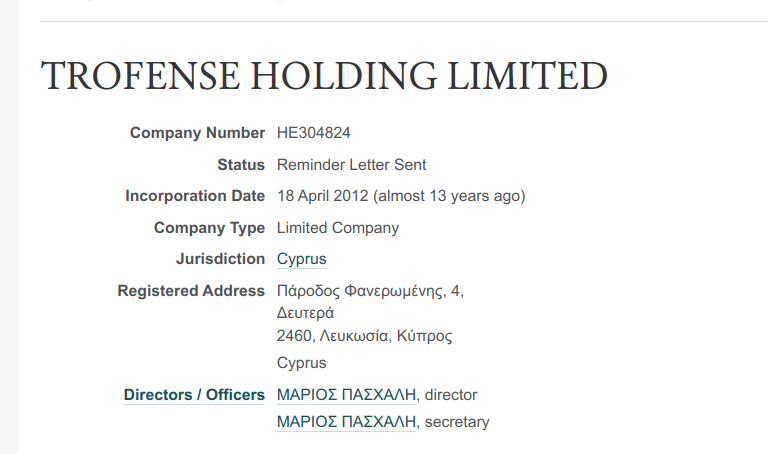

The bank acquired for 1.454 billion rubles was supposed to replenish the developer's services with new products, but it seems that it actually opened a path to Cypriot firms, which had already been trampled by the ex-owner. TROFENSE HOLDING LIMITED, which was connected with the affairs of the then Bogachev Bank, is still operating, which seems to hint at opportunities.

Photo: opencorporates.com

Moreover, the company is still involved in some financial litigation in Russia, where other offshore companies have also appeared.

By the way, earlier Bogachev highlighted ties with three more offshore companies - Farisia Limited, Labini Investments Limited and TANGIER HOLDINGS LIMITED. Labini in January 2025 through the court was unable to close her account in this bank, which had already been transferred to a company close to Vorobyov for a year.

The most interesting thing is that in the story of offshore companies and the bank there were some loans and pledges of property. It will be interesting if later one of the offshore companies files a lawsuit against Samolet, claiming a pledge in the form of bank assets.

So, for example, after its sale to the Aircraft, the bank appears in at least two cases as a co-defendant. And it seems like in both cases the guarantee agreement is disputed, but the plaintiffs who are asking to cancel this agreement are the very persons involved in ambiguous stories involving offshore companies.

By the way, GK Samolet is also very loyal to offshore companies. For example, in the history of one of the companies - "SPB Renovation" inherited the Cypriot RETANSEL ENTERPRISES LTD. This part of the division is actively mastering budget (and not only) money in St. Petersburg, surfacing in scandals. Thus, SZ SPB Renovation - Krasny Kirpichnik LLC, with which the St. Petersburg Property Relations Committee signed over 250 government contracts worth more than 6.5 billion rubles, was mentioned in the scandal about the sale of social apartments to Smolny at a price higher than market prices.

GK Samolet has not recently left the media news in light of the fact that, having collected loans, he was so credited that shareholders ran out of it. The first to merge was the public adviser to Governor Vorobyov, God Nisanov, known for his chuyka for trouble, and he was not even stopped by the fact that the interests of the governor's family were protected in the developer. And they say that it was Nisanov who brought the Plane to the St. Petersburg market, and here such a demarche.

Following Nisanov's departure, they started talking about the fact that co-founder and main shareholder Mikhail Kenin has been looking for a buyer for his third of the shares, which are estimated at 26.5 billion rubles, since the fall of 2024. For six months, he managed to drain only 1.33%, although they could pull at least 1 billion rubles. Apparently, Kenin really needed a cache.

But such jumps from the Samolet and the position of Kenin, called the architect of the company's success, against the background of the change of CEO led to confusion and vacillation. Investors began to lay the risks of a potential bankruptcy of the Aircraft and discuss a technical default at the next offers, hinting that in 2025 sales would drop by another 11%, and debts would not go anywhere.

In the same piggy bank of problems, a decrease in the credit rating in December 2024. ACRA then, among other things, noted the need to refinance a significant part of the company's bond debt in the context of peak rates in 2025.

In light of this, the appearance at the head of the Samolet bank of a former employee of the Trust looks like a subtle hint at the possible fate of the asset.

.jpg?v1739335359)

.jpg?v1739335359)